UK’s energy regulator Ofgem, in an aim to promote transparency of Great Britain’s energy market to consumers, market players and other interested parties, regularly reports about the energy supplier’s performance and where they stand in the market.

From consumer research to market indicators, Ofgem conducts performance monitoring of the suppliers and the overall status of the energy market and publishes the findings in a data portal for easier access.

Here are the latest figures on energy supplier performance you can use as a reference to know more about the market today.

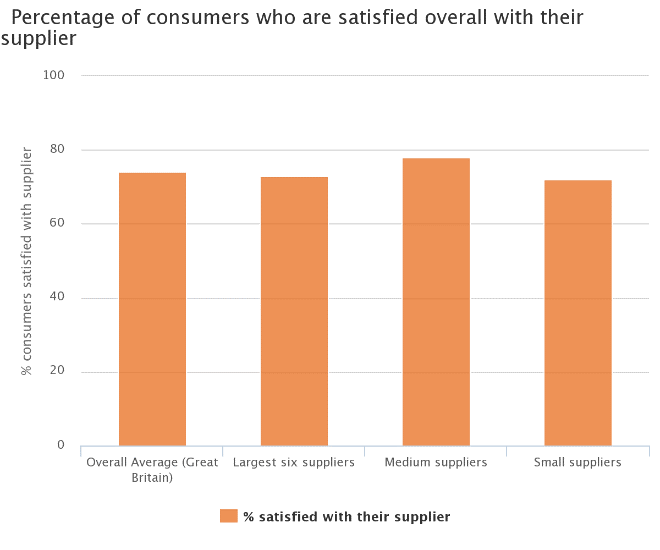

Overall Consumer Satisfaction

Based on the data shown in the Ofgem Consumer of the Energy Market Survey for the third quarter of 2019, 74% of respondents are satisfied with their energy supplier. Those who are availing of services from the Big Six, the UK’s six largest suppliers, have a reported 73% satisfaction rate. For medium supplier customers, 78% said they are pleased with the services they receive, while 72% of small supplier consumers indicate being satisfied with their provider.

The data showed that medium suppliers gained the highest satisfaction rating from customers, although the largest and smallest energy providers don’t fall behind. Overall, the energy market received a fairly positive rating from British consumers.

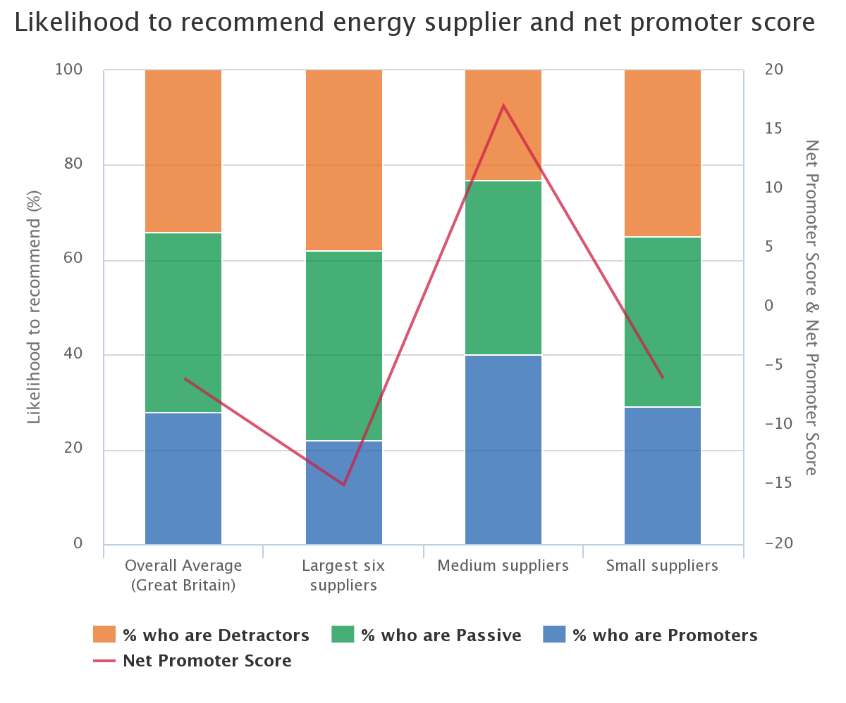

Net Promoter Score

Net promoter score is taken from the Consumer Engagement Survey, which is yet to be published by Ofgem. For the survey, respondents are asked to rate how likely they are to recommend their supplier to a colleague or friend, based on a scale of 0 to 10.

The data revealed that the overall average net promoter score of British suppliers is -6, with more detractors (34%) and passive customers (38%) than promoters (28%).

Out of the net promoter score by the size of the supplier, only the medium suppliers received a positive rating from respondents at 17 points. The Big Six suppliers have the poorest score at -15 points, while small suppliers take the middle spot at -6 points.

The results showed that medium suppliers have more promoters than detractors, indicating that customers are more likely to recommend them to another person, while big and small suppliers have more detractors than customers willing to promote their brand.

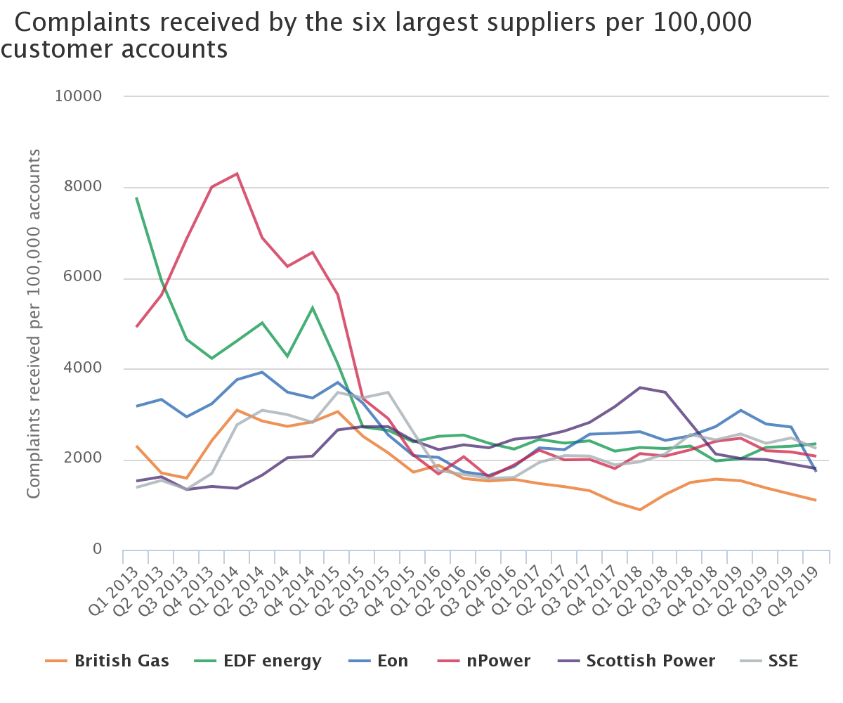

Complaints Received – Six Largest Suppliers

The graph reflects quarterly complaints received by the Big Six per 100,000 customers between Q2 2013 and Q4 2019. Complaints have seen a significant dwindle between 2014 and 2015, with nPower receiving a big bulk Q2 of 2015. By Q4 of 2019, EDF energy received 2,341 complaints, although other suppliers have had their fair share.

British Gas has received the least complaints from 2017 throughout 2019, considering that it has the most significant market share among the Big Six.

The data implies a marked improvement in the way large suppliers have been delivering services and handling complaints in the past few years.

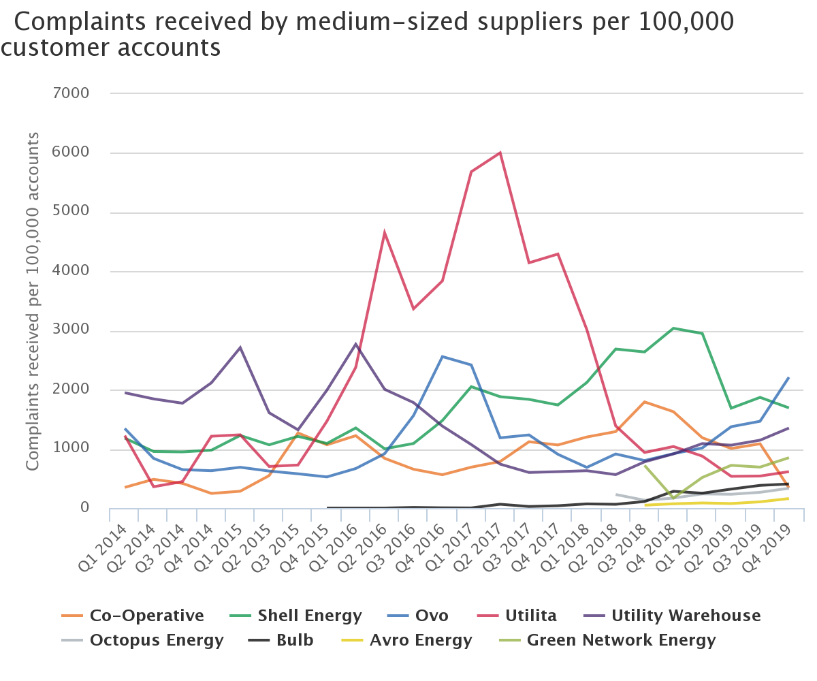

Complaints Received – Medium Suppliers

Suppliers data reflecting the complaints medium suppliers have gotten per 100,000 customers from Q1 2014 to Q4 2019 illustrated a somewhat steady amount over the years, except from Q2 2016 to Q4 2017, wherein Utilita had seen a massive spike in complaints, especially in Q2 2017 (6,005 entries).

The latest figures from Q4 2019 showed Avro Energy receiving the least complaints at only 160 per 100,000 customers, although the firm’s data is limited from Q3 2018 only

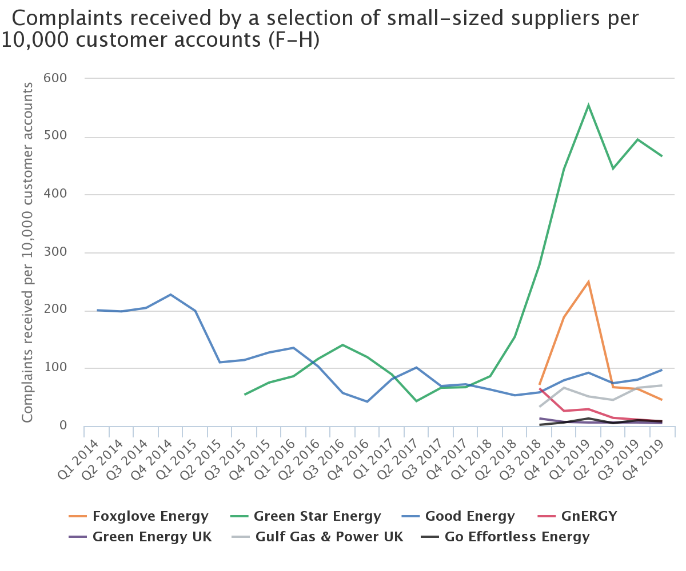

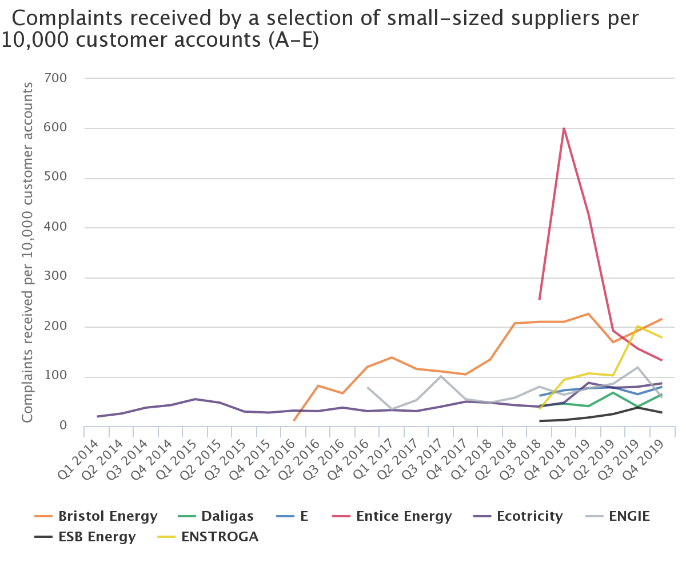

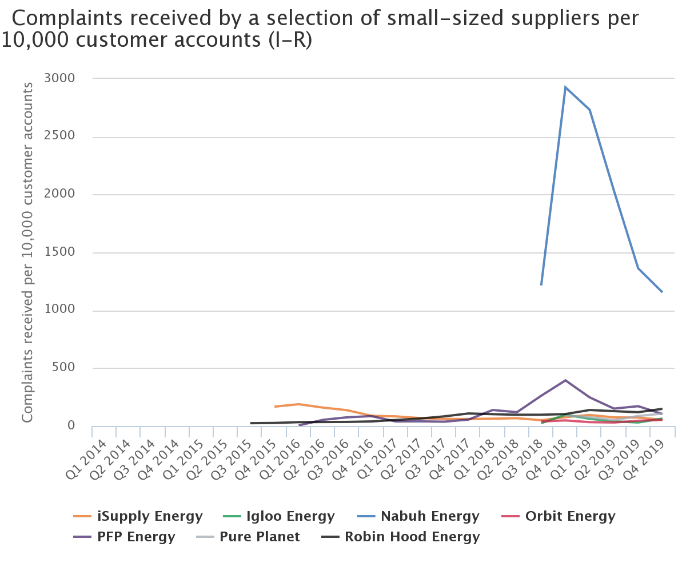

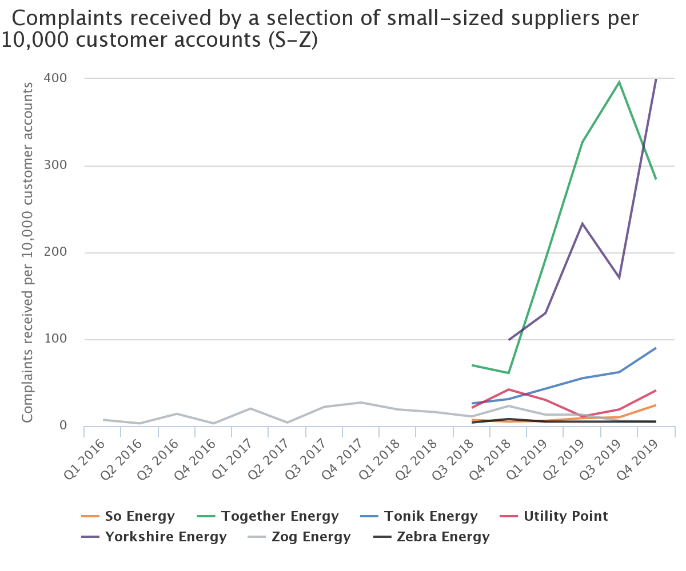

Complaints received – Small Suppliers

Data for complaints received for small suppliers per 10,000 customers are divided into sections by alphabetical order. The figures are taken from supplier records as early as Q1 2014 to Q4 2019, although most small suppliers have been around for only a year or two.

Some of the poor-performing small suppliers have gotten a high number of complaints, with Nabuh Energy (2,732 entries) getting the most in 2019.

Ecotricity and Good Energy are notable small suppliers for having been around since 2014 but are yet to receive more than 100 complaints in the past couple of years. Meanwhile, Zebra Energy hasn’t received more than ten complaints since Q4 2018.

Average Tariff Prices

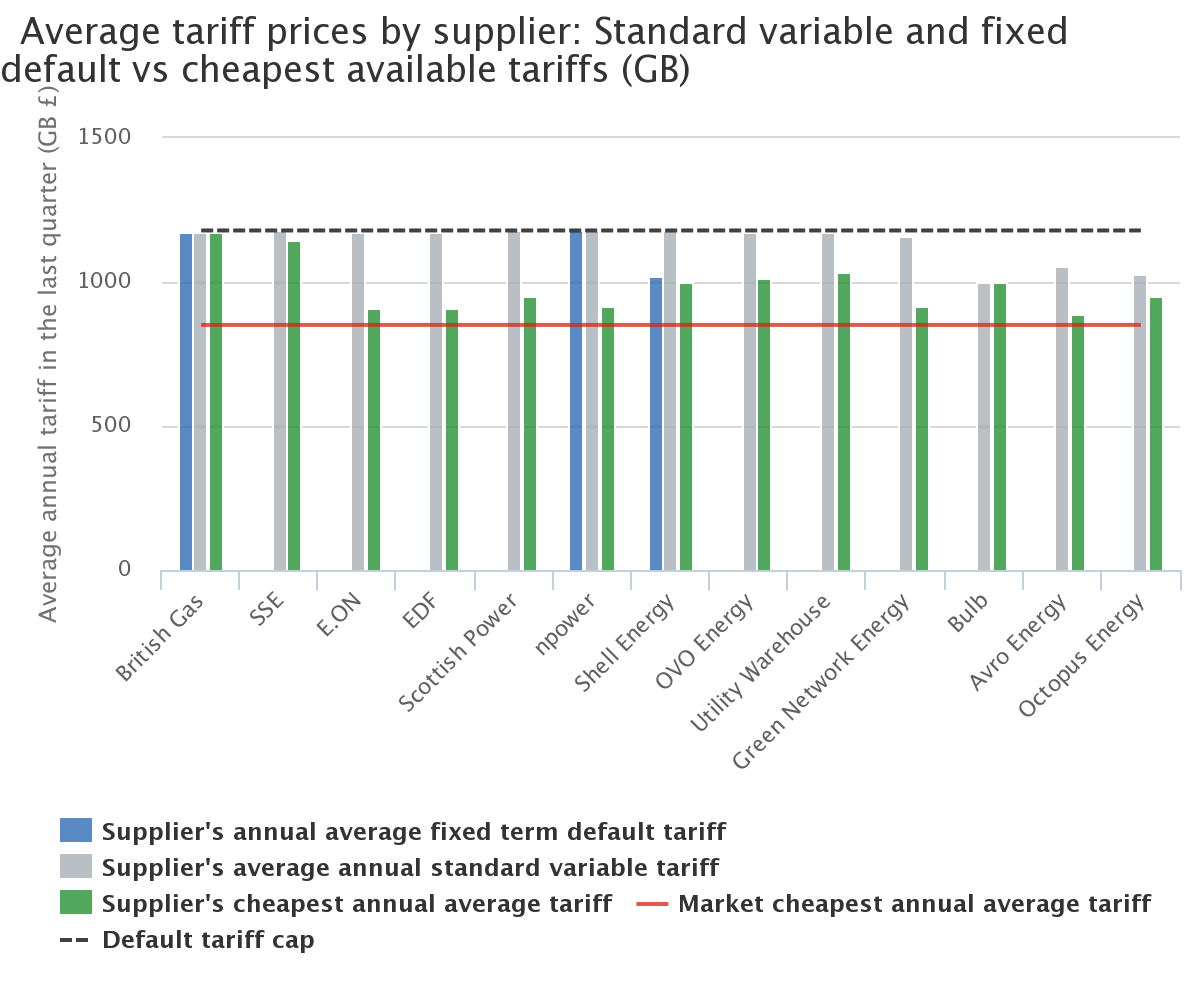

The chart shows the comparison of average tariff prices for 13 larger suppliers, which includes the standard variable tariff (SVT) or fixed default tariff if available, and the cheapest tariff offer of the firm. Based on the illustration, all the tariffs are above the market’s lowest annual prices on average.

British Gas, the largest supplier, has the highest SVT, fixed tariff, and cheapest tariff out of all the other suppliers. The prices sit just below the default price cap of £1,179 set by the energy regulator Ofgem. In comparison, Bulb Energy offers the lowest SVT at only £999.

Meanwhile, Avro Energy delivers the cheapest annual average tariff at only £891, less than half the amount that British Gas offers as its lowest, which is £1,174.

Out of 13 supplies, ten providers, including all of the Big Six, have set their SVT prices just below the annual price cap.